Today, Australia has one of the most developed economies in the world and is one of the most innovative and high-tech countries. The ability to successfully utilize all available resources, opportunities, and competitive advantages has made Australia one of the key players not only in the region but also in the modern global world.

Powerful use of solar potential for the development of the energy cluster is the main industry trajectory. To this end, many Australian solar companies are making every effort to make the idea of solar energy widely accepted and accessible. Business representatives – from startups to large companies – understand how significant it is to support this trajectory of the industry.

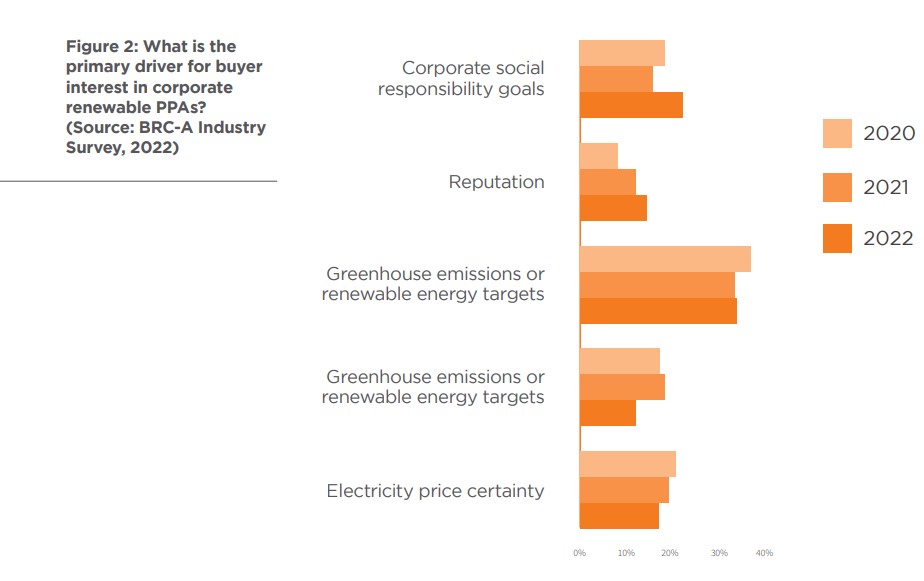

According to the Clean Energy Australia 2023 report provided by the Business Renewables Center Australia Industry Survey, 2022, the main drivers of company interest in using corporate PPAs are:

- Greenhouse emissions or renewable energy targets;

- Corporate social responsibility goals;

- Electricity price certainty.

Therefore, in this article, we will take a closer look at the main financial insights on investment and financial growth through solar energy, and talk about potentially successful startups and large corporations that have already achieved significant results.

The Rising Stars: Australia’s Solar Startups

In general, Australia has one of the best conditions for the technical development and popularization of the idea of using solar energy in its economy. This is due to the favorable location of the continent in the sub-equatorial, tropical, and subtropical climatic zones. This allows the industry to actively develop and take energy literally from daylight.

That’s why new solar startups are being actively created and developed in the region. For example, here are some representatives of startup projects that show good potential:

- Reposit Power. The company entered the Australian market in 2012 and offers customers innovative technological solutions to optimize the use of electricity. The company uses the latest solar batteries, inverters, and solar panels. All the tools help reduce electricity bills by 30-40% to 70%. Using the Reposit No Bill service guarantees 100% coverage of your electricity bill for 7 years (even if prices rise).

- Solar Analytics. Since 2013, the project team has been developing and delivering intelligent software solutions for residential rooftop solar systems. The startup’s mission is to provide the world with solar energy from rooftops. The company provides several options for a package of services with dynamic control and monitoring according to the needs and capabilities of customers.

- Okra Solar. The Okra project aims to achieve the complete eradication of energy poverty and provide #PowerToThePeople. The company offers a Mesh-Grids technology innovation for optimal electrification of customer households. The main features of the Mesh-Grids model are good capacity, and systematic interconnection with neighboring houses to redistribute excess power.

Every startup project operating in the field of solar energy and renewable energy sources faces very serious challenges.

After all, achieving energy independence and utilizing the solar potential to the fullest is a difficult task. However, such projects help to improve the situation of Australian solar farms, popularize the idea of competent energy consumption, and have a positive impact on some environmental factors.

Titans of the Industry: Established Solar Magnates

In addition to the activities of startups that are actively developing and gaining more power, there are also large corporations in Australia that have already managed to create a brand name and reputation for themselves. This list includes the following business representatives:

- National Solar Energy Group (NSEG). The largest solar company in Australia. The main activity of the company is the installation of high-tech solar systems for residential, public, or commercial projects.

- 5B. The company was launched in 2013 and has already been involved in the implementation of more than 145 projects, including King of the Hill off-grid gold mine, Borroloola community solar farm, and others.

- GEM Energy. The business started operating in 2013. It is a leading commercial and residential solar energy company. Winners of the CEC Solar Award 2019. Strives to provide integrated solar solutions to minimize energy costs.

These and other large representatives of the business sector allow us to make adjustments to the use of solar potential. In general, responsible businesses have a positive impact on the formation of policy shaping.

In addition to direct industry influence, one can see the role business plays in lobbying for solutions and protecting public interests. Companies can also join industry associations to jointly set the agenda. This will make the issue of solar energy more visible to society.

Financial Insights: Investment and Returns in Solar Ventures

Solar investments are a promising solution that can bring good results to stakeholders. However, it is important to keep in mind some of the peculiarities of the Australian renewable energy financing process.

The use of solar energy requires expensive, high-quality equipment and the constant involvement of new innovative solutions. All these technical aspects require significant investments from investors. In addition, companies that have implemented solar panels or other energy generation tools in their systems must take into account maintenance costs.

If clients are considering investing in solar startup projects or giant companies, they should conduct a preliminary risk assessment. It is important to understand how profitable project financing will be and what potential returns can be expected. And what is better – to join the team of a large corporation or to support an interesting project with a reasonably innovative development scenario?

Although financing the solar energy industry can be a complex process that requires careful attention, this step allows you to successfully diversify your portfolio to minimize the risks of losing all your capital. To do this, interested investors can combine investments in both startups and large corporations with long experience, and test the profitability of such a solution in practice.